The Bank of Watertown

was founded in 1854 by A. L. Pritchard, who was a New York financier. A three-story bank building was erected in

the 1850s. Not only was this an important

bank, but the original building housed the offices of prominent pioneer

attorney Theodore Prentiss, and its upstairs was the early home of Watertown's

most significant fraternal group, the Masons.

In 1916 the three-story

building was replaced by the current two-story structure.

SCROLL DOWN

FOR DETAILED INFORMATION

website watertownhistory.org

ebook History of Watertown, Wisconsin

Bank of Watertown

Incorporated 1854

14 E Main

This is the second building on

this site. The Bank of Watertown was

founded in 1854 by A. L. Pritchard, who was a New York financier. The Bank of Watertown built a three-story building

at this location in the 1850s. Not only

was this an important bank, but the original building housed the offices of

prominent pioneer attorney Theodore Prentiss, and its upstairs was the early

home of Watertown's most significant fraternal group, the Masons. On January 29, 1916, the above building was

formally opened to the public

Watertown Gazette, 08 01 1929

The history of the Bank of Watertown

is tied up closely with that of the community itself. Up until a year or so before this bank was

organized, Watertown had no banking facilities, the nearest approach to a

banking institution being Daniel Jones' broker office. When a resident of the community needed a

loan and had no satisfactory collateral, he was very apt to borrow of his

grocer or butcher and repay the loan with the products of his farm or

garden. Then, in 1852, the Jefferson

County Bank was organized in Watertown.

It survived for about nine years but in 1862, according to the files of

the Wisconsin state banking authorities, it liquidated and passed out of

existence after paying all claims against it dollar for dollar.

1853-1863

The years preceding the Civil War

were years of political, social and financial unrest, particularly in the newer

states of the West. From 1853 to 1860

there was constant friction between the pro-and anti-slavery factions. When the war finally broke out in the spring

of 1861, Wisconsin had 109 state banks with an outstanding circulation of

$4,500,000, two-thirds of which was secured by rapidly depreciating bonds of

southern and border states. Within two weeks after the fall of Fort Sumter, 38

of the 109 Wisconsin banks were closed, and public confidence was not wholly

restored until after the great Union victories of 1863.

Throughout this troubled period,

however, the Bank of Watertown was able, as a result of capable and

conservative management, to continue its service and keep faith with its

customers and the community.

1854

A. L. PRITCHARD

City of Watertown, Wisconsin -

Architectural and Historical Intensive Survey Report: 1986-1987. City of

Watertown Historic Preservation Project, August 1987, pp 214-225.

Two of the early banks in

Watertown were begun by Yankees. Daniel

Jones, a native of New Hampshire started the Jefferson County Bank in the

1850s. It was suspended in 1862 and

Jones joined with William Dennis who had formed the Bank of Wisconsin. Together they formed the Wisconsin National

Bank (116 W. Main St). The Bank of

Watertown was founded by A. L. Pritchard, a New Yorker who never moved to

Watertown. Its long-time cashier,

though, was William H. Clark, another New Yorker who came to Watertown in

1854. Its original building (14 E. Main

St.) was replaced by a new structure in 1916

1854

WILLIAM H. CLARK

The History of

Jefferson County, Wisconsin by C. W. Butterfield, 1879

William

H. Clark, cashier of the Bank of Watertown; came to Milwaukee in 1852, and to Watertown

in 1854. He organized the bank that year

and has been connected with it ever since.

Mr. Clark organized the gas company here, in

connection with A. L. Pritchard, and conducted the works for several

years. He has been in the banking

business continuously since August 4, 1854, over a quarter of a century. Mr. Clark is a native of Chemung Co., N.Y.

1854, ORGANIZATION OF

Watertown Gazette, 08 01 1929

In 1854, the year after the

Jefferson County Bank opened for business, the Bank of Watertown came into

existence and has served continuously ever since without even a change in name.

Watertown was incorporated as a

city in 1853, and its first mayor Theodore Prentiss,

was in office when the Bank of Watertown was organized. The population at the

time the city charter was granted was about 4,000, but was rapidly

increasing. Wisconsin was just acquiring

its first railroad facilities, the Milwaukee Road completing its line from

Milwaukee to Waukesha in 1851, to Madison in 1854, and to Prairie du Chien in

1857, while the Northwestern reached Janesville from the southeast in 1855 and

Fond du Lac in 1858.

1854

FIRST

STOCKHOLDERS' MEETING

Among the founders of the bank

are some of the most prominent pioneer settlers of this territory, men who

played a leading part in the early development of the community. At the first stockholders' meeting, held on

August 1, 1854, A. L. Pritchard, Luther A. Cole,

Linus R. Cady, John Richards and Ebenezer W. Cole were chosen directors of the

bank.

A. L. Pritchard was elected

president, and William H. Clark, cashier.

Daniel Jones, Amos Steck, and

John P. Roose were also among those actively interested in the organization of

the bank, and Theodore Prentiss joined the group shortly after. Among the later presidents of the institution

were William Buchheit

and Frank E. Woodard. Among later

officers and directors were Jesse Stone, Marshall

J. Woodard, E. J. Brandt, W. C.

Stone, Constance Wiggenhorn, and C. H.

Jacobi.

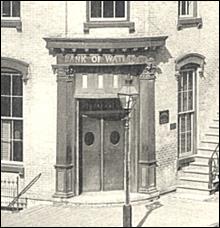

1855

ORIGINAL

BANK BUILDING

Shortly after the bank was

organized it erected a three-story brick building on the site of its present

structure. That building, which was the

bank's home for sixty years, was regarded at the time of its erection as the

best bank building in the state outside of Milwaukee. It was built of Watertown

brick. Vault doors were brought from New

York City, and the vault, which would seem almost primitive compared with the

one the bank owns today, was hailed as a notable example of advanced

construction.

11 22 BANK

RAISED CAPITAL TO $100,000

The Bank of Watertown has now

completed its arrangements for raising its capital to $100,000. The bills are already struck off, and by the

first of January 1856, the bank will commence operations with greatly increased

means for accommodating one of the most profitable and growing business

communities in Wisconsin. The Bank of

Watertown commenced business in this city a little more than a year ago with a

capital of $25,000. A short time since

its stock was raised to $50,000, and now this latter amount is about to be

doubled in order to keep pace with the calls that are made on it for larger

accommodations. This short and plain

story speaks volumes in favor of our city, and tells with unerring certainty

that rapidly as we are going ahead, we are going along safely. Mr. A. L. Pritchard is the President, and Wm.

H. Clark, the Cashier of the Bank of Watertown—gentlemen in whose experience

and ability the public may repose the utmost confidence. WD

1857 LOCATION OF READING CENTER (pre public library)

Long before 1900, however, the

idea of a free public library was in the dreams and

wishful thinking of many Watertown residents.

In 1857 the young men's association rented a room and opened a reading

center in the old Bank of Watertown building on Main and North First

streets. So many readers came that the

association moved to the top floor of the Cole building.

c.1859

MAIN STREET IN DECADE BANK WAS BORN

c1860

THEODORE PRENTISS

The law office of Theodore Prentiss

(Watertown’s first mayor) was above the Bank of Watertown.

1868

COL. SOLLIDAY

Upon his arrival in Watertown Col. Solliday opened dental parlors over the

Bank of Watertown, where he remained three years, finally locating on Main

Street (Solliday & Meyer, 117 Main) where he practiced his profession until

his retirement from active duties.

Solliday held several positions

of trust in Watertown, among them four years on the school board, part of the

time its president; alderman of the

1881

1882

10 18 WILLIAM H. CLARK, Cashier of the Bank

of Watertown, death

of wife Charlotte A. Clark WR

10 23 LETTERING ADDED TO WINDOWS

Some very handsome

gilded and tinted lettering was done last week on the south windows of the Bank

of Watertown by W. C. Raue. Watertown Republican, 10 23 1889

c.1890

1891

1892

09 30 SAFE KEEPING

The Bank of Watertown is making several substantial improvements on its

building. Its building was one of the finest

in the state when erected some thirty-eight years ago, its outside walls being

built of pressed brick, and the trimmings of iron. After thirty-eight years the building is in

good condition, and one of the most prominent on Main Street. This institution passed safely through all

financial storms during this long period, and by the sound financial policy of

its present management has placed itself in the front ranks of the financial

institutions of the state. . . . The

principal improvement, will be its steel burglar-proof vault. Its vault, originally built in the most

substantial manner, with very heavy solid walls, the entire interior being of

stone, will be lined with burglar-proof steel plate, the vestibule and doors of

the vault alone weighing 17,000 pounds.

The outer door will have a triple time lock and automatic bolt

work. This door is of immense

weight. It closes air tight and opens

and closes as stated periods automatically, there being no opening nor spindle

through the door whatever. The second

door is a heavy steel plate combination door.

The vestibule also a contains day gate.

Inside of this burglar-proof vault will be placed the deposit boxes

rented to the bank’s customers, and also its burglar proof time-lock safe,

which is also provided with a second steel door. The reserve cash of the bank will thus be

protected by four burglar-proof steel doors, a triple and a double time

lock. WG

1893

TWO DRAWINGS, both from 1893 issues of Weltburger [1] [2]

1893

"NOTICE TO DEPOSITORS"

One episode in the bank's history

in which it takes particular pride, and one that is characteristic of the high

sense of responsibility that has always been a feature of the bank's

management, took place in 1893. That was

a year of financial panic in the United States, and banks in many parts of the

country were in acute distress. The Bank

of Watertown remained perfectly sound, as it had through previous panics, but

gossips aroused by the general lack of public confidence in banks spread rumors

that frightened some of the depositors.

To quiet depositors and restore confidence, on July 26th, the bank posted

in its window and published in the newspapers the following "Notice to

Depositors":

Owing to the present unsettled condition throughout

the business world, we, the undersigned directors of the Bank of Watertown,

hereby guarantee with our private fortunes all the deposits now in the bank and

all deposits made during the year 1893.

There is due depositors in this bank, $220,000. The assets of this bank are $300,000. Added to this ample amount of assets we

pledge our private fortunes.

We take this occasion to thank the business

community, farmers, and other customers for their liberal patronage and desire

to show our appreciation of the same with this absolute guarantee.

Dated, Watertown, Wis. July 26, 1893.

Wm. Buchheit,

Jesse Stone,

M J Woodard,

Theodore Prentiss,

C Wiggenhorn,

E J Brandt

This confidence-inspiring

document accomplished its purpose.

1894

09 26 FREE HOME SAFE FOR CUSTOMERS

Bank keeps the key

c.1897

1902

COUNTING

ROOM

1906

08 09 BURGLAR ALARM SYSTEM

The scene of activity about the

Bank of Watertown the past few days and nights has convinced those who have

watched the preparation that the installation of a burglar alarm system is no

easy task and in fact take a far greater amount of strenuous labor and time

than the average person would imagine. The new system is being installed by the

Invincible Protection Company of Monroe, the equipment being manufactured at

Cedar Rapids, Iowa.

The system is what is known as

the open and closed circuit, the vault of the bank being enclosed in a

veritable network of cables containing electric wires so that it would be

utterly impossible for a burglar to gain access to the vault without giving an

alarm that would almost wake the dead. The work of installing the new system is

in charge of T. J. Weirich of Monroe, who has four experienced assistants

helping him, beside local assistants. The work was started last Saturday, Mr.

Weirich working and supervising the work through to Monday a period of

forty-eight hours without any sleep. It is expected that it will require a

week's time yet to complete the task of installing the system. In the course of

operating it was necessary to drill holes through the steel plates of the

vaults in order to run the cable. It was found that ordinary drills would

scarcely touch the steel, so the process used was by electricity, a common arc

light carbon being used as the drill. This process is a very interesting one to

watch, the display of light being virtually like a miniature electrical storm.

The operation has been watched by many of our citizens and all have found Mr.

Weirich and his assistants very courteous in explaining the details of the new

system. WDT

1907

A deputy factory inspector has

ordered the Bank of Watertown to build a fire escape on either the south or

east side of its building at the north west corner of Main and First streets as

the hall in the third story being used as a test hall (sic). It is passing strange that such an order

should be issued as it is less than four years ago that the owners of the

building put up a good and sufficient fire escape on the north side of the

building. The building is small and

heated with a furnace, the only stove in it being in the Post hall and the

buildings on either side are warmed by steam from the Masonic Temple. To put up another fire escape where ordered

would deface the building and cost at least $200 and is not required for the

safety of those who occupy the building.

1910

11 18 PASSED MILLION DOLLAR MARK

The reports of the Bank

of Watertown and Merchants' National Bank of Watertown show that in capital,

surplus and deposits those two banks have now passed the million dollar mark, which

speaks well for the business interests of Watertown. The Wisconsin National Bank's deposits,

capital and surplus are over $610,000, and judging from its last report, that

old and popular banking institution is also on a solid financial basis. WG

1911

01 06 HAPPY NEW YEAR 1911

In entering upon another business

year we desire to thank our depositors and patrons for the loyal confidence

reposed in this bank during the 56 years in business. It will be our purpose in the future, as in

the past, to place our services at your command—our strength and security at

your disposal. Bank of Watertown. Capital $150,000. Surplus $30,000. Established 1854. Three percent interest paid on time

deposits. WG

07 06 FRANK E. WOODARD ELECTED PRESIDENT OF THE

BANK OF WATERTOWN

At a meeting of the board of

directors. of the Bank of Watertown held on Thursday, June 28, 1911, Frank E. Woodard, for many years the efficient

cashier of the bank, was elected president to fill the vacancy in the office

caused by the death of Wm. Buchheit, and Fred Gamm was elected a member of the

board of directors, and he was promoted from the office of assistant cashier to

that of cashier. The promotion of both

men was with the general approval of all the stockholders of the bank, and

finds great favor with its patrons and the public in general.

1914

05 28 NEW DEPARTMENT in Bank of Watertown. In talking with the cashier of the Bank of

Watertown today he told us [Watertown

Gazette] of a new department to be opened next week in their bank. This new service is to be given free to

everybody who wishes to use it, whether they have ever done business with this

bank or not.

“The time is forever gone when a bank's only duty was to accept

deposits and return the money when wanted by the depositor,” said Mr.

Gamm. “The up-to-date bank must give

their patrons every possible advantage in their money matters. Few people have the opportunity to study

financial affairs as does the banker and he soon learns of the new methods

worked out for helping his patrons.

While it is true that money was made to be spent, it is also true that

there are many ways to spend it. The man

who gets the greatest [good] from the money spent is an exception to the

rule. Such a man we call thrifty. Thrift means skillful handling of money in

order that the greatest amount of good comes from it.

“The time is forever gone when a bank's only duty was to accept

deposits and return the money when wanted by the depositor,” said Mr.

Gamm. “The up-to-date bank must give

their patrons every possible advantage in their money matters. Few people have the opportunity to study

financial affairs as does the banker and he soon learns of the new methods

worked out for helping his patrons.

While it is true that money was made to be spent, it is also true that

there are many ways to spend it. The man

who gets the greatest [good] from the money spent is an exception to the

rule. Such a man we call thrifty. Thrift means skillful handling of money in

order that the greatest amount of good comes from it.

“Everybody wishes to be

thrifty. Our Thrift Savings Club system

will give them the easiest possible way to develop thrifty habits. A large part of any thrift program is to plan

ahead for the money to be spent. The

vacation trip, the life insurance payment, Christmas expenses, taxes, paying

off a mortgage, building or buying a home and various other matters come up and

must be provided for.

“We have the easiest and best

system for providing for these various funds and cordially invite the readers

of The Gazette to call and have the

system explained to them.”

09 17 NEW BUILDING for Bank of Watertown

Ferd Behlke Secures Contract / An

Investment of $35,000.

Ferdinand Behlke of this city has

secured the contract for the new Bank of Watertown building, exclusive of

heating, plumbing and decorating. Work

on the new building, which is to be erected on the site of the present

building, will begin at once. The rear

half of the building will be completed first and then the front part, so that

there will be no interference with the business of the bank. When the rear part is finished the business

will be conducted therein till the entire building is completed, which will be

during the summer of 1915. The building

will represent an investment of $35,000, and it is designed by A. C. Clas, one

of Milwaukee’s most celebrated architects.

WG

Additional source: Engineering

News, Volume 72. McGraw-Hill Publishing Company, 1914

10 24 FARE-REFUNDING SALE, full

page Weltburger

ad

1915

02 25 THREE YEARS IN WAUPUN

On Saturday Judge Grimm in Circuit

Court sentenced R. M. Shogry, alias E. M. Esper, to three years in the state

prison at Waupun. On January 13th Shogry

attempted to defraud the Bank of Watertown.

His home is at Mosonton, Pa. Last

January he called at the Bank of Watertown and deposited a small amount of cash

and a number of worthless checks, and afterward endeavored to draw against the

account, but the bank management was too smart for him and had him

arrested. He plead guilty before Judge

Grimm and received his sentence on Saturday.

WG

--- SITE PREPARATION

FOR NEW BANK

04 20 TEMPORARY QUARTERS IN THE MASONIC TEMPLE

The Bank of Watertown will occupy

temporary quarters in the Masonic Temple

building while the construction of the front part of the bank’s new building

is in progress. When completed,

Watertown will have one of the most handsome and commodious bank buildings in

the state and one of which the citizens of the city may justly feel proud. The Watertown News

10 28 NEW BANK BUILDING UNDER CONSTRUCTION

Building operations in Watertown have shown

marked activity during the last year.

Many new residences have been erected, as well as a number of business

buildings. The chief pride of Watertown

is the new building of the Bank of Watertown, which institution is the oldest

of its kind in Jefferson county. Its new

home, which will be ready for occupancy about Nov. 1st, stands at the northwest

corner of First and Main streets. The

ground floor is equipped with the most modern of bank fixtures, while the upper

floors will house several commodious office suites which will be occupied by

such firms as the individuals as the Old Line Life Insurance Company, Attorney Wm. H. Woodard, F. J. Prentiss [T. & J.

Prentiss] and W. C. Stone; while the president of the bank, Mr. F. E. Woodard, will also have private

offices above the bank. WG

1916

NEW BANK

BUILDING

On January 29, 1916, the present

building was formally opened to the public with a reception at which visitors

were given an opportunity of inspecting the structure and its equipment.

It is interesting to note that,

while the Bank of Watertown grew steadily and paid satisfactory dividends for a

great many years, its most rapid expansion has taken place since the opening of

the present building just thirteen years ago.

An article appearing in the Watertown Daily Times on the day this

building opened [1916] called attention to the fact that the bank's deposits

were then over $900,000 and remarked that the institution "bids fair to be

numbered among the 'million dollar banks' within a reasonable time." That this prediction was extremely

conservative is shown by the fact that deposits in 1929 were about $2,000,000

and total resources are approximately $2,300,000. The present capital is $200,000 - four times

the amount of the original capital - and added to this is $165,000 in surplus

and undivided profits.

02 01 NEW BANK BUILDING DETAILED The

Watertown Weekly Leader, 01 Feb 1916

Scarce would one think of the

Bank of Watertown without calling to mind the history of Watertown; for in its

line of commercial endeavor the Bank of Watertown is the pioneer financial

institution of the city — the oldest now in existence.

When the bank received its

charter on May 1, 1854, the first mayor of Watertown, Theodore Prentiss, was at

the head of the city government.

The first president of the bank

was A. L. Pritchard, and the first cashier was W. H. Clark. The stockholders were men who made Watertown

a commercial possibility, and whose names are indelibly impressed on the city’s

history — Lucius Cady, Daniel Jones, Theodore Prentiss, John Richards, John W.

Cole and Luther Cole.

The officers and directors laid

the foundation for the present substantial financial institution along lines of

safe banking practice, and there has not been an hour since these pioneers

launched the project of banking in the city that any officer or depositor in

the Bank of Watertown has had cause to regret the stability of the bank or the

policies of financial transactions laid down by these men.

Two years after being chartered,

the total bank deposits in Watertown were $105,000, of which amount the Bank of

Watertown boasted $36,500, the remainder being in charge of the Jefferson

County Bank, which liquidated a few years later

The bank, shortly after

organization, erected what was at that time as substantial and magnificent a

structure at the corner of Main and North First streets as the building thrown

open for business last Saturday is considered the last word in banking house

safety and convenience in this day. The

bank occupied this three-story brick structure for more than sixty years, and

temporarily vacated the rooms, taking quarters in the Masonic Temple a year ago

while the new building pictured on this page was being erected. After some years with Mr. Pritchard as head

of the bank, William Buchheit became president and C. H. Jacobi was chosen as

cashier, but the latter retained his position only about a year, resigning on

account of ill health.

The bank, shortly after

organization, erected what was at that time as substantial and magnificent a

structure at the corner of Main and North First streets as the building thrown

open for business last Saturday is considered the last word in banking house

safety and convenience in this day. The

bank occupied this three-story brick structure for more than sixty years, and

temporarily vacated the rooms, taking quarters in the Masonic Temple a year ago

while the new building pictured on this page was being erected. After some years with Mr. Pritchard as head

of the bank, William Buchheit became president and C. H. Jacobi was chosen as

cashier, but the latter retained his position only about a year, resigning on

account of ill health.

At the same time Jesse Stone

became vice-president. Mr. Stone,

however. did not devote his entire time to the institution, but took an active

interest in politics, being elected to the office of lieutenant-governor. At one time he was an active candidate for

the nomination of governor, surrendering his claims in the convention to Robert

M. La Follette when our senior senator was made his party’s choice for chief

executive in his first gubernatorial campaign.

Under Mr. Buchheit’s

administration Eugene and Constance Wiggenhorn, founders of the Wiggenhorn

Brothers, cigar manufacturers, entered the bank’s organization, and Constance

was elected to the directorate.

Another Watertown pioneer to

invest in the bank’s securities was M. J. Woodard, of the firm of Woodard &

Stone, cracker manufacturers, while Theodore Prentiss, lawyer and capitalist.

retained his interest.

02 01 NEW BANK BUILDING OPENS

[same date] HEARTY WELCOME EXTENDED VISITORS

BANK OF WATERTOWN RECEIVES

VISITORS IN MAGNIFICENT NEW HOME.

Wives and Daughters of Officials

Act as Hosts—Beautiful Floral Pieces.

Historic Relics Shown Visitors,

Probably one of the most

brilliant and whole-hearted welcomes ever extended to the citizens of Watertown

by a business concern was when the Bank of Watertown opened its doors for the

transaction of business Saturday morning.

The finishing touches had been

completed by the contractors on the magnificent new building at Main and North

First streets, and it presented a handsome appearance, both as to exterior and

interior.

Nothing had been omitted by the

bank officials to make visitors feel at home, and those who braved the storm

which raged all day were well repaid.

Wives and daughters of the

officials and directors were hosts to the lady visitors, presenting each with a

flower as a remembrance of their visit.

Officials of the bank extended

welcome to the male visitors, the passing out of cigars being one of the

gracious acts of entertainment.

The guests were in all instances

shown through the bank’s new home, which was a revelation to the visitors in

substantial construction, neatness of finish and conveniences.

Carnations and roses were used in

profusion in the decorations, while palms and ferns were interspersed.

Claude Reynard’s mandolin

orchestra furnished the music and remained on duty until the reception came to

a close at 10 o’clock in the evening.

One floral piece which attracted

much favorable comment was the “Welcome,” made of red carnations, and which was

prominently displayed.

Directors of the other three

Watertown banks sent beautiful floral pieces as their compliments to the Bank

of Watertown entering its new home, as did also some of the business men of the

city.

One interesting souvenir which

the officers displayed was a history of Watertown, in pamphlet form, published

in 1856, by order of the city council, going into extensive detail to set forth

the city’s advantages as a manufacturing center, and explaining the

transportation facilities.

BANKERS

PLEDGE THEIR PERSONAL FORTUNES

A placard displayed was of more

than passing interest, recalling the days when a run on the bank was

threatened. This was during the panic of

1893, in Cleveland’s administration, when banks all over the country were going

into bankruptcy, and to question the stability of any financial institution was

a matter of course. Rumors of a

collapse, not only of the Bank of Watertown, but of any bank, was not a matter

of surprise, and to retain confidence in the bank the following notice was

published in the various Watertown newspapers and displayed in the bank:

NOTICE TO DEPOSITORS.

Owing to the present unsettled

condition throughout the business world, we, the undersigned directors of the

Bank of Watertown, hereby guarantee with our private fortunes all the deposits

now in the bank, and all deposits made during the year 1893.

There is due depositors in this

bank $220,000. The assets of this bank

are $300,000. Added to this ample amount

of assets we pledge our private fortunes.

We take this occasion to thank the

business community, farmers and other customers for their liberal patronage,

and desire to show our appreciation of the same with this absolute guarantee.

Dated, Watertown, Wis., July 26,

’93.

Wm. Buchheit,

Jesse Stone,

M. J. Woodard,

Theodore Prentiss,

C. Wiggenhorn,

E. J. Brandt. Watertown Weekly Leader, 02 01 1916

1929 DIAMOND ANNIVERSARY

Watertown Gazette, 08 01 1929

Bank of

Watertown Observes Its Diamond Anniversary

Observing the occasion with an

open house celebration to which the entire community is invited and with a free

theatre party for the children, the Bank of Watertown on Saturday, August 3rd,

will mark the completion of three quarters of a century of uninterrupted

service. The bank first opened for

business in August, 1854, when Franklin Pierce was President of the United

States.

The bank will be open on Saturday

from 9 a.m. to 9 p.m., and depositors, friends, and the public at large are

invited to attend the celebration.

Officers, directors, and employees of the institution will be present to

receive the guests. The party for the

children will be held at the Classic Theatre

on Saturday afternoon, admission being by complimentary tickets which are being

given out at the bank to children of 15 years and younger.

Present officers of the Bank of

Watertown are H. Mulberger,

president; J. F. Prentiss, vice president; L. J.

Lange, cashier; and H. L. Schumann, manager of the bond department. Directors are E. J. Brandt, Alex Buchheit, F. W. Gamm, H. Mulberger, E. A. Pratt, J. F. Prentiss, F. E.

Woodard, and W. H. Woodard.

The force, the members of which

through courtesy and close attention are an important factor in the bank's

success, are: H. A. Mitzner, E. G. Thompson, Walter Manthey, Mary Burke,

Waldemar Kohn, Anne Kress, and Gertrude Fleischer.

The bank offers a complete range

of modern financial services under the general headings of commercial banking,

savings, safe deposit, investments, and trust service.

1954

07 04 FOURTH

OF JULY PARADE

-- -- FORMER BANK BUILDING REMODELED

Remodeled in 1954, the former

bank building has been altered by the installation of metal storm windows on

the second floor and by the covering of the majority of windows on the lower

story as well as by the addition of a modern storefront in front of the

original corner entrance. Only two original windows located at the north end

remain on the structure.

08 14 BANK OF WATERTOWN CENTENNIAL OBSERVANCE

Flowers, good wishes and between

2,500 and 3,000 callers marked the open house at the Bank of Watertown Tuesday

afternoon and evening which was part of the institution’s centennial observance

now underway. Callers came from all

walks of life, and some were from out of the city. The flowers came in all colors and arrangements,

sent by Watertown business concerns, individuals and out of town associates. The visitors were shown through the bank’s

recently expanded quarters and routine banking operations were explained. Officers, directors and staff members shared

in greeting the many visitors who kept up a steady stream throughout the

afternoon and evening.

-- -- COMMEMORATIVE PUBLICATION

1956

06 30 FARMERS AND CITIZENS BANK ACQUIRED

After today Watertown will have

but three banks instead of the present four. With the close of business this

evening, the Farmers and Citizens Bank (1957c,

300 E Main, city assessor image) will cease to exist, according to

announcement made public today. The negotiations which led to this step were

underway for some time, but public announcement of the plan was withheld until

today.

As of today the Bank of Watertown

is assuming the deposit liabilities of the Farmers and Citizens Bank. All loans

and mortgages will be payable hereafter to the Bank of Watertown. At a special

meeting of the stockholders of the Bank of Watertown held late Wednesday

afternoon they ratified a plan to increase the capital stock of the bank from

$200,000 to $250,000 and endorsed the proposal previously acted on by the board

of directors to assume the deposit liability of the Farmers and Citizens Bank,

the announcement said. All loans and mortgages will be payable hereafter to the

Bank of Watertown. WDT

c.1950s-60s

Those were the days the Bank

closed at 3:00 and Fridays reopened from 6:00 tp 8:00.

1957 DIRECTORS

City Directory Ad: Meyer, O E; Kern, Ray;

Weihert, A W; Lange, L J; Kramp, L B; Schumann, H L

c.1957

1960

03 26 Bank acquired property; 106 Madison St, 8 E

Main, 10 E Main WDT

12 14 L. J. Lange, 313

Elizabeth Street, president of the Bank of Watertown since 1946, announced his

retirement from banking at the end of this year. His plans to retire did not come as a

surprise since he had made it known last year that this would be his last year

as a banker. He is a member of the board

of directors of the bank. Mr. Lange, who

was born in Watertown, went to work for the Bank of Watertown in 1911. On June 2, 1924, became cashier of the bank,

succeeding the late Fred Gamm who had been cashier for many years. On Jan. 10, 1946, Mr. Lange was elected

president, succeeding Henry Mulberger at the time of his retirement from

banking. WDT

1961

01 12 The Bank of

Watertown elected a new president, Harold L. Schumann. He succeeds L. J. Lange who announced in

December that he would retire from banking.

Mr. Lange was elected vice president and cashier last night. He will remain with the bank until a new man

comes into the institution to join the staff.

Walter F. Manthey was elected assistant cashier, R. J. Hoge was elected

assistant vice president and J. V. Anderson was elected assistant cashier. Directors elected last night are Ray J. Kern,

L. B. Kramp, A. Weihert, L. J. Lange and Harold L. Schumann. WDT

08 02 The Bank of

Watertown last night was granted permission to make use of the city hall alley

in order to carry out its plans for a drive-in banking facility. The vote was 8 to 5. There was little or no debate on the issue

and during the discussion, Gerald E. Flynn, vice president and cashier of the

bank revealed that the bank hopes some day to acquire the present city hall to enable it to

carry out a greater expansion program.

Mr. Flynn said that the day is undoubtedly coming when a new city hall

or municipal building will be constructed in Watertown and that when that time

comes the bank will certainly be interested in an opportunity to acquire the

present city hall site. WDT

12 31 L. J. Lange,

313 Elizabeth Street, finally brought to a close his career as a banker last

evening. More than a year ago Mr. Lange

announced plans to retire from the Bank of Watertown where he has been

associated for a little more than 50 years but circumstances arose in the bank,

including the death of Harold L. Schumann and several staff changes, which made

it impossible for him to sever his connections until now. He still has the

title of vice president and is also a bank director. Mr. Lange formerly served as

president of the bank following the death of Henry Mulberger. Mr. Lange last

year gave way to Mr. Schumann for the presidency and accepted one of the vice

presidencies. After Mr. Schumann’s death, Gerald E. Flynn who had been brought

to Watertown to join the bank staff was elected president and Mr. Lange

continued as one of the vice presidents and a director. WDT

1962

01 02 L. J. Lange,

who retired last week from the Bank of Watertown with which he was associated

for more than 50 years, and James J. Schmied, well known Watertown builder,

announced the formation of a real estate and building partnership to be known

as Schmied and Lange, Inc. Mr. Schmied,

who is president of the Watertown Home Builders Association, has been a builder

here for the past 12 years, specializing in homes. He resides in route 5 on highway 26. Mr.

Lange, who resides at 313 Elizabeth Street, said that the new business will be

located at 112 North Second Street, which for years has been the office

quarters of Kading and Kading. WDT

1963

09 06 The Bank of

Watertown has made an offer, subject to negotiations, to acquire the present city hall property in North First

Street [110 N First] in order to carry out its long standing plans for

expanding its present bank facilities.

The offer was made public last night at the meeting of the common

council. That the bank seeks the

property has long been a matter of record.

In fact some years ago, when Lawrence J. Lange was still president of

the bank, it was announced at a meeting of the council that the bank wanted the

present city hall when and if a new municipal building were constructed. Such construction is now underway in Memorial

Park and the city will occupy the new building late next year, vacating the

present city hall which was erected in 1884.

WDT

1964

01 08 BRANDT FAMILY MEMBER

BACK ON BOARD OF DIRECTORS

The Bank of Watertown held its

annual meeting last night. Elected to the

board of directors are Ray J. Kern, Edgar J. Kellerman, L. J. Lange, A. W.

Weihert, L. B. Kramp, Gerald E. Flynn and E.

James Quirk. Mr. Quirk is the newest

member of the board of directors. This

rounds out the board membership by bringing in a Watertown industrialist. This brings a member of the E. J. Brandt

family back into the Bank of Watertown organization, Mr. Quirk’s grandfather,

the late E. J. Brandt, having been cashier of the bank many years ago.

1965

01 13 RELOCATE FROM FIRST AND

MAIN TO NORTH SECOND STREET

The Bank of Watertown today

announced plans to relocate. It will

abandon its present Main and North First Street building and move to a new and

modern bank building to be constructed in the North Second Street at Madison

Street section. The site which the bank

will acquire, and on which it has held options, runs along North Second Street

from Madison Street to Jones Street and involves the Kopp buildings, the

Schuenemann property and the Kellerman property which now houses the Kroger

Supermarket in Madison Street. WDT

The M&I Bank is now located on land which was acquired from a number

of different businesses. Among them were

Koerner and Pingel Hardware Store, Kopp Sheet Metal, Kroger Food Store, Elmer

and Beats Tavern, Marachowsky’s Grocery Store, Kellerman Insurance Agency, and

Hofbrau Tavern.

1966

01 15 PREPARATION OF NEW SITE

AT NORTH SECOND STREET

Work has begun on demolishing the

first building located on the site of the future new Bank of Watertown. The building being torn down was among the

pioneer bakery establishments in Watertown, at the corner of North Second and Jones

Streets. According to the bank’s plan

for its new building, the new bank site runs along the east side of North

Second Street, from Jones Street south to Madison Street, and includes the

former Schuenemann property, the Kopp buildings and the Kellerman property

which formerly housed the former Kroger Supermarket in Madison Street. WDT

07 07 LEO’S STAR HARDWARE

SITE

The Bank of Watertown, having

acquired the property occupied by Leo’s Star Hardware store in North Second

Street, part of the site which the bank purchased last year for its new bank

building, is planning a closing out sale so the business can be terminated and

work begun on the demolition of the last of the buildings making up the new

bank site. The new bank property runs

along North Second Street, from Madison Street to Jones Street, as well as

property in Madison Street, running up to and including the former site of the

Kroger Grocery store building. Most of

the buildings have already been demolished and cleared for bank construction to

begin. WDT

08 04 LAST BUILDING ON SITE

DEMOLISHED

Wrecking the last building units

on the site of the new Bank of Watertown has started. The bank, designed by Law, Law, Potter and Nystrom,

Madison architects, will be located in North Second Street, between Madison and

Jones Streets, including landscaping and customer parking facilities. Other buildings in the nearly one block area

were demolished earlier. The architects

have been given the word to prepare the final working sketches and will also

construct a scale model. WDT

1967

02 27 BUILDING PERMIT FOR NEW

LOCATION

The new Bank of Watertown project

in North Second Street “saved the day” for new building in the city in February

and helped make a presentable showing in the line of new building permits for

the month. The total for the month stands at $228,600, of which $206,400 is

represented by the permit granted to the bank for construction of its new

building. That is for the building only.

WDT

07 10 SOLD TWO BUILDINGS TO

FISCHERS

The Bank of Watertown, which is

to vacate its present building at Main and North First Streets before the end

of the year and move into its new building in North Second Street, between

Madison and Jones Streets, sold the two Main Street buildings it acquired some

years ago as part of a plan which then called for expanding its present banking

facilities, it was revealed today. The

two buildings, formerly occupied by the New York Market and the Mother Nature's

Cupboard, a health food establishment, has been sold to the Chas. Fischer and

Sons Co. which will utilize the two properties for expanding and remodeling its

store. The Fischer store has for many

years occupied the major area of the Masonic Temple which it purchased last

year from the Masons who will vacate their lodge quarters before the end of the

year and move to a new Masonic Temple in Madison Street.

12 18 CORNERSTONE LAYING

CEREMONY

A cornerstone laying ceremony was

held at the new Bank of Watertown building, located at the second block in

South Second Street. Pictures and other

items were placed in the box. Pictures

included one of the first Bank of Watertown building, erected in 1854, at First

and Main streets; of the present building, built in 1916, at the same location,

and of the officers and directors who participated in the ground breaking

ceremony on February 14, 1967. Other

items placed in the box included: An

issue of the Daily Times of January

15, 1965, which carried a page one story telling of the decision of the

stockholders and board to erect a new bank building, and a Dec. 20 issue of the

Times.

1968

01 30 RELOCATES TO NORTH

SECOND ST.

The Bank of Watertown today began

its operations in its new bank building, located on North Second Street, one

block north of Main Street. Starting

with the closing of the old bank at 8 o’clock on Friday night, the moving

operation began. The biggest single task

in connection with the moving operation was moving the seven-ton vault

door. The door arrived at the new bank

at noon Saturday and was in place by 1:30 p.m., but another five hours was

required to level it. By 6:30 p.m., the

work was completed, and the door was closed and locked at the new bank

building.

02 06 OPEN HOUSE AT NEW

LOCATION

Open House at the Bank of

Watertown’s new home, located on North Second Street, one block north of Main

Street, will be held on Friday and Saturday.

The Friday hours are from 9 a.m. to 8 p.m.; and the hours on Saturday

are from 10 a.m. to 5 p.m. Coffee and

doughnuts will be served during the Open House.

This new building is a one-story structure located on the northeast

corner of North Second and Madison Streets.

The site covers nearly one block.

The new building is complete in every respect, and provides the last

work in convenient and attractive banking facilities. Outside two depository windows are located on

the east side of the building. Parking

space is provided on the north side of the structure.

02 08 OCTAGON HOUSE MURAL

07 07 ROBERT WESTRICK

Robert W. Westrick, 32, of

Detroit, Mich., has joined the staff at the Bank of Watertown as of today. He will be replacing Miss Lorraine Schatz,

who will be retiring at the end of the year after over 16 years of service with

the bank. Prior to that she was private

secretary for the late Attorney William H. Woodard who was associated with the

bank. For the past 11 years Mr. Westrick

has been employed with the National Bank of Detroit as a branch manager. He joined the Detroit bank upon graduation

from the University of Notre Dame. His

wife is the former Donna Welsch, daughter of Mr. and Mrs. Bernard Welsch, 597

South Third Street.

12 28 LORRAINE SCHATZ

RETIREMENT

Miss Lorraine I. Schatz, senior

trust officer of the Bank of Watertown, will retire on Tuesday. She was employed by the bank on March 17,

1962, as a secretary after working in a similar capacity for the late Judge

William H. Woodard for a period of over 32 years. Because of her extensive probate background

she was elected to head the bank’s trust department in January of 1962. Gerald E. Flynn, bank president, today

expressed regret over her leaving the bank.

He, the bank’s employees and the board of directors extend to her many

years of true contentment and joy in her well-earned retirement.

1969

10 13 AUTO SHOW SPONSORED BY

THE BANK

Over $190,000 worth of

automobiles were displayed in the parking lot of the Bank of Watertown for the

new car show sponsored by the bank with the cooperation of all city car

dealers. Live music was provided by Tommy

Voigt and his band and free refreshments were served.

Link

to four images within portfolio

1990

04 03 FLYNN RETIREMENT

Herald F. Flynn, who has served

as the president and chief executive officer of M&I Bank in Watertown since

1961, has announced his retirement from that position. Flynn, 63. said his retirement will take

effect on July I, 1991. After July I of

this year, he will continue to serve in a part-time capacity as a consultant to

the bank until he retires. The Kaukauna

native began as vice president and cashier at the Watertown hank in June of

1961. In October of that year, Flynn was

appointed president and chief executive officers. After retiring Flynn plans to continue to

reside in Watertown with his wife. Joan, at 1082 Boughton St. They have three children. “Twenty-nine years is a long time in any job,

let me tell you. I e joyed it, very much

so. We love Watertown, and Watertown has

been good to us." he said.

1991

03 05 M&I BANK REMODELING

The M&I Bank of Watertown has

begun an extensive three phase remodeling project which is expected to be

completed in the middle of May, according to William Shoemaker, president. The initial phase of the project addresses

exterior signage consisting of bronze bank name lettering, parking and traffic

direction signage, illuminated bank logo identifier and customer

information. The second phase, which is

currently underway, addresses the installation of additional exterior windows

along the west side of the building.

Also included in this stage of the remodeling is the relocation of

extensive offices, conference rooms and the establishment of a personal banking

center. The final phase of the

remodeling includes recarpeting, reupholstering of furniture and draperies in

colors and coordinates appropriate to financial institutions. WDT

1992

01 16 OFFICERS & DIRECTORS

William E. Shoemaker Jr. was

re-elected president and chief executive officer of M&I Bank of Watertown

at the annual meeting of the bank Wednesday.

Other officers are H. Bruce Kasten, executive vice president;

Christopher Jurss, cashier and controller; Larry Schuett, vice president real

estate; Patrick Caine, commercial loan officer; Daniel Thousand, vice president

agriculture; Wayne Duris, assistant vice president agriculture; Larry

Braunschweig, vice president retail, and Ora Kuckkan, auditor. Directors reappointed to their positions were

Shoemaker, Kasten, Bertram Beltz, William Kwapil Jr., Edward McFarland,

Alexander Napolitano, George Neuberger, William O’Brien and Jerald Theder.

Re-elected as director emeriti were Edward Dobbratz, Dr. V. R. Bauman, E. James

Quirk, Edgar J. Kellerman and L. B. Kramp.

WDT

06 24 PATRICK CAINE PROMOTION

The board of directors of the

M&I Bank of Watertown has approved the promotion of Patrick J. Caine to

assistant vice president of commercial lending.

Caine is a graduate of the University of Wisconsin-Whitewater and

Marquette University. He comes to

Watertown from the Marshall & Ilsley Corp. in Milwaukee. Caine will oversee the bank’s credit

administration and its regulatory compliance function, in addition to his new

responsibility. WDT

10 17 JOHN EBERT ELECTED

John H. Ebert was elected

president and chief executive officer of M&I Bank of Watertown at a special

board of directors meeting Wednesday evening.

Ebert, 39, succeeds William Shoemaker who resigned as president on Sept.

24. Ebert has served the last four years

as president of M& I Tri-County Bank in Marshfield. Prior to that he spent six years as

commercial lending vice president at M& I First National Bank in

Wausau. Ebert holds a bachelor’s degree

in business administration from St. Mary’s College in Winona, Minn., and a

master’s degree in business administration from the University of

Wisconsin-Oshkosh. A native of

Wisconsin, he has more than 15 years of banking experience. WDT

1993

11 09 M&I BANK AND VALLEY BANK

COMBINE

Upon completion of the M&I

and Valley merger, which is expected in mid-1994, the M& I Bank of Watertown

and Valley Bank will combine, creating a single operating bank with offices in

Watertown, Beaver Dam and Juneau.

Following the merger, David M. Hanson will become chairman and chief

executive officer and John H. Ebert will be named president. Hanson is currently chairman and chief

executive officer of Valley Bank South Central and Ebert is president of M&

I Bank of Watertown. The combined assets

of the M& I Bank of Watertown and Valley Bank South Central will be

approximately $213 million. WDT

1994

09 20 DAVID HANSON MOVES ON

David M. Hanson, chairman and

chief executive officer of M& I South Central, headquartered in Watertown,

has been named chairman and chief executive officer of M& I Bank S.S.B. in

Sheboygan. Hanson will begin his new duties on Monday, Oct. 3. He plans to remain in Watertown for some

months before moving permanently to the Sheboygan area. John H. Ebert, who is currently serving as

president of M& I Bank South Central, will continue in that capacity and

will assume the responsibilities previously held by Hanson. “Dave has been an outstanding member of the

Watertown community and an excellent leader at the bank. He will be missed,” Ebert said. “M& I South Central remains committed to

Beaver Dam, Juneau, and Watertown. We will

continue to focus on strengthening these communities through our business and

civic activities,” he added.

2007

01 20 GREG SCHROEDER VP

Local resident Greg Schroeder,

who works at the M&I Bank offices in Watertown and Beaver Dam, has been

promoted to vice president. Schroeder,

who has over 13 years of financial services experience, is a senior financial

adviser and has been with M& I since 1996.

Schroeder has earned bachelor’s degrees from Hamline University in St.

Paul, Minn., and a master’s degree from Marquette University. WDT

01 20 TODD FISCHER JOINS BANK

Todd Fischer has joined M&I

Bank, 205 N. Second St., as a business banker.

Fischer was the vice president and general manager of Fischer’s

Department Store in Watertown for over 19 years. In his new role as a business banker, Fischer

will assist his business customers with their daily financial needs. Fischer is a graduate of the University of

Wisconsin-Madison and is active in the community as a board member of Watertown

Chamber of Commerce. He was the chairman

for the Watertown Streetscape Committee and is the founder of the Watertown

Central Business Association.

2008

01 26 TODD FISCHER PROMOTED

Todd Fischer, a business banker

with M&I Bank in Watertown, has been promoted to the title of officer. Fischer earned a bachelor’s degree from the

University of Wisconsin-Madison and is a graduate of the Wisconsin Banker

Association Introduction to Commercial Lending School. He founded the Watertown Central Business

Association in 1992 and served as the organization’s inaugural president until

1997. He was the vice president and

general manager of the former Fischer’s Department Store

in Watertown for over 19 years. WDT

07 26 TODD SCHEID HIRED

Todd Scheid has been hired by the

Watertown office of M&I Bank as its new vice president of business

banking. Scheid has over 24 years of experience

in banking, most recently with ISB Community Bank and Town and Country

Bank. Scheid received his bachelor’s

degree from the University of Wisconsin-Whitewater in 1985 and is a graduate of

the Madison Graduate School of Banking.

10 26 PATRICK CAINE

M& I Bank senior vice

president Patrick Caine will become the market president of the local business

starting on Jan. 1, 2009. Caine will

replace John Ebert, who announced his retirement Monday. Caine began his career with M& I in 1985

in Milwaukee and moved to the Watertown office in 1991. In addition to his new duties as market

president, Caine will continue in his role as a business and agricultural

banking manager for M& I’s southwest region. Caine has served the community in various

capacities over the years and is the current board chairman of the UW Health

Partners Watertown Regional Medical Center.

He is also a trustee for the Joe Davies Scholarship Foundation and

serves on the finance committee of St. Henry’s Parish.

2020

08 05 WHITE OAK BUILDERS OCCUPANCY

Remodel

of 14 E. Main (scroll through)

2022

12 04 PARADE OF HOMES LOCATION

The original Bank of Watertown

building built in 1854 has been a staple on Watertown’s Main Street for over

150 years. It has transferred hands and

gone through major renovations in that time to become what it is today.

In 2019, Dan and Maggie Wegner,

owners of White Oak purchased the building with the goal of keeping the

original features and showcasing the grandeur of the space.

The original scrolled plaster

work adorns the 14’ high ceilings and columns in the main showroom area. During renovations they were able to open the

original window openings to allow floods of natural light into the space again.

Keeping with the traditional feel

of the space and encompassing some modern flare they have renovated the main

room to be the show case and retail location for White Oak Design and

Build. Offering general contracting

services for new home construction and remodeling, design services, and unique

home décor. Their focus is to assist

homeowners in bringing their ideas, wants, needs, and concepts for their ideal

home to reality.

|

c1897 City Hall right |

c1900 Right. N. First & Main |

c1900 Left. No First St |

|

|

|

|

|

|

|

|

Cross

References:

E J Brandt's inventive talent came to the fore

while he was employed as a cashier in the Bank of Watertown. Tiring of counting money for railroad

payrolls, he invented an automatic cashier and in 1890 founded his own company

to manufacture this product, Brandt Inc.

Death of Richard Hoge, 1983

![]()

History of Watertown,

Wisconsin